Money Laundering: When detection is impossible by Financial Institutions

Money Laundering: When detection is impossible by Financial Institutions

For sometimes now, financial institutions have been equipped with traditional anti money laundering practices, wherein they have a robust BAU process, which takes CEAT ( Customer, External Entities, Accounts, Transactions) to monitor transactions. This has a sequence of established steps, which detect possible suspicious alerts by running rule-based scenarios or patterns, apply scores, correlate similar alerts to form cases, and finally, compliance and operational users investigate and categorize these as ‘Truly Suspicious’ or ‘False Positive’. ‘Truly suspicious’ cases get further scrutinized and very seldom lead to follow laws under financial crime and compliance governed by the country or jurisdictions.

While advancements in technology and regulatory frameworks have made detection more sophisticated, there are still scenarios where detection becomes extremely difficult:

- Sophisticated Techniques: Money launderers often employ sophisticated techniques to disguise the origin of illicit funds. This could involve layering transactions through multiple accounts and jurisdictions, making it challenging to trace the original source.

- Use of Cryptocurrencies: Cryptocurrencies present a unique challenge due to their decentralized nature and pseudonymous transactions. Although blockchain technology can provide transparency, certain cryptocurrencies offer features that make it difficult to trace transactions effectively.

- Shell Companies and Nominee Directors: Money launderers may set up shell companies with nominee directors to obscure the true ownership of funds. These entities can be located in jurisdictions with lax regulatory oversight, further complicating detection efforts.

- Integration with Legitimate Transactions: Laundered funds are often integrated with legitimate business transactions, making it harder to differentiate between lawful and unlawful activities.

- Fragmented Regulatory Landscape: Variances in regulatory requirements across jurisdictions create loopholes that money launderers exploit. Weak enforcement and cooperation between regulatory bodies can hinder detection and investigation efforts.

- Emerging Technologies: Rapid advancements in financial technology (fintech) introduce new avenues for money laundering. For example, peer-to-peer payment systems and decentralized finance (DeFi) platforms may lack robust anti-money laundering (AML) measures.

- Complex Global Transactions: Globalization has led to increasingly complex financial transactions involving multiple parties across different jurisdictions. Identifying and analyzing these transactions for potential money laundering activities requires extensive resources and coordination.

- Insider Complicity: Money laundering schemes can involve individuals within financial institutions who knowingly facilitate illicit transactions or turn a blind eye to suspicious activities. Insider complicity can undermine internal controls and detection mechanisms.

Addressing these challenges requires a multi-faceted approach involving enhanced regulatory oversight, collaboration between financial institutions and law enforcement agencies, investments in technology and data analytics, and increased awareness and training for compliance personnel. However, even with these measures in place, achieving complete eradication of money laundering remains a daunting task.

Over a period of time, this process, though highly effective for BAU AML activities and regulatory commitments, now leads to few shortcomings. Some of these are –

(a) High volume of false positives resulting in high usage of manual efforts spent in case investigation

(b) To detect suspicious alerts, rule-based patterns are used, which work only on historical data and do not have the capability to prescribe or predict suspiciousness in newly brought CEAT data.

(c) Limitation in detecting links ( or relationship) between entities, Synthetic identities, Entity Resolution and other sophisticated ways being practiced by the modern launderer. As money launderer advances with their tricks to outsmart the established tools and techniques, detection procedure needs similar advanced in both technologies and process.

(d) Limitation of detecting money laundering activities by the bank or financial institutions simply because parts of suspicious activities may not be within bank’s observable dataset.

In financial crime and compliance space, there are many more discussions, possible solutions and ideas available for the first 3 items depicted above. Rule optimizer, Machine learning algorithm along deep learning and graph analytics can mostly solve these problems. However, surprisingly one will find hardly or no information on the fourth one. Let me try to elaborate this.

Money laundering is a multi-layered complex process passing through one or more financial institutions. To track and establish money laundering activities, it is essential to trace end-to-end transactions and related entities ( customers, accounts, external entities, client banks, corresponding banks etc.). Lets take a look at the below picture showing a possible money laundering case –

For representation purpose, a simple diagram with layered transactions have been demonstrated above, wherein money launderer uses multiple banks ( situated across the country/region/continent) to do “strategic” and “periodic” transactions to deceive both the origin of the money as well as the ultimate beneficiary of the money. Now each bank is equipped with established AML BAU procedures, however, each of these banks has visibility only the data that pass through it. It certainly gets the external entity information or other party information, however, as they do not have the full-KYC data ( and some times, entities are synthetic and cannot be related, sometimes entity resolution is unable to relate two entities due to lack of data or missing links), it is impossible for individual bank to identify suspiciousness in such transactions. Each bank sees nothing “seriously wrong” with these transactions. However, an end-to-end careful look would certainly establish the fact on how the money has been placed, then layered and finally converged to single or limited closely related accounts to deceive the ultimate beneficiary. This is possibly one of the reasons why establishing a real SAR ( Suspicious Activity Report, True positive) is so difficult.

Now, question arises, if banks are permitted to see all transactions with party data across other banks, will it be possible then to detect such malicious transactions. The answer would be mostly “Yes”, but partly “No”. Why “No”? Here are my thought.

Finding real identities doing transactions or being associated with the transactions help detect possibilities of suspicious activities. Money launderers try to fake real identities by using synthetic data or mule accounts or unrelated KYC information. Now in each bank ( taking the above example), if these launders (or a group of launderers organizing the whole crime) try to pose as different identities while taking part in each of these transactions, it is extremely difficult to relate such entities even if each bank gets the information of the end-to-end transactions. In summary, finding the real identity of each entity and relationship between each entity with other entities in global space is essential to trace out and categorize transactions as suspicious or legitimate. Secondly, it is essential to find the ultimate originator and ultimate beneficiary to detect the true nature of the illegal activities.

Here is an approach to circumvent this. Now this has to be dealt both at policy, regulatory establishment of sharing data between FIs, country legislations, as well as at provisioning technologies to empower FIs to detect and disrupt illegal and illicit activities. I will assume here sharing data will be established in near future ( one of such example is project COSMIC in Singapore wherein six major banks will share data with each other for detecting illicit network). I will hereby concentrate on a possible technical approach for this.

When I ponder over more and more on money laundering use cases, one obvious observation appears distinctly. It is a perfect use case for graph network problem. Nodes are nothing but the various kind of entities – customers, accounts, external entities, client banks, corresponding banks etc. and transactions are nothing but edges. Graph naturally fits here. Graph network can evolve over a period of time, which also fits with the newly added transactions to the FIs. This has also an advantage over rule-based patterns wherein only a limited transactional data are looked back. On the other hand, graph does not “forget” older transactions.

Before I get into details on Graph Neural Network (GNN), I would like to mention that a comprehensive strategy involving policy, regulatory frameworks, data sharing, legislation, and technological empowerment can significantly enhance the detection and disruption of money laundering activities. Here’s how each component contributes:

- Policy and Regulatory Establishment:

- Clear and robust policies and regulations provide a framework for financial institutions (FIs) to follow in their anti-money laundering (AML) efforts.

- Regulatory oversight ensures that FIs implement effective AML procedures, conduct due diligence on customers, and report suspicious transactions to authorities.

- Policies can mandate the adoption of best practices and the use of advanced technologies for AML compliance.

- Data Sharing between FIs:

- Sharing data among FIs allows for the aggregation of information, enabling the detection of suspicious patterns and activities across multiple institutions.

- Collaboration through information sharing networks or regulatory platforms facilitates the identification of complex money laundering schemes that span multiple accounts or institutions.

- Data sharing can be facilitated through secure channels while adhering to privacy and confidentiality regulations.

- Country Legislations:

- Strong legislative frameworks empower authorities to investigate and prosecute money laundering activities effectively.

- Laws should provide for the sharing of information domestically and internationally, enabling cross-border cooperation in combating financial crimes.

- Penalties for non-compliance should be stringent to deter financial institutions from engaging in illicit activities or turning a blind eye to suspicious transactions.

- Provisioning Technologies:

- Advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics can analyze vast amounts of financial data to identify unusual patterns or anomalies indicative of money laundering.

- Blockchain and distributed ledger technology (DLT) can enhance transparency and traceability in financial transactions, making it more difficult for criminals to launder money.

- Regulatory technology (RegTech) solutions automate compliance processes, streamlining AML efforts and reducing the risk of human error or oversight.

By integrating these components, financial institutions can strengthen their AML capabilities and improve their ability to detect and disrupt illegal and illicit activities. However, effective implementation requires collaboration between public and private sector stakeholders, as well as ongoing investment in training, technology, and regulatory enforcement. Additionally, regular evaluation and adaptation of strategies are essential to stay ahead of evolving money laundering threats.

Now, Graph neural network (GNN) technology holds promise for detecting money laundering by leveraging its ability to analyze complex networks of interconnected entities, such as financial transactions, customers, and accounts. Here’s how GNNs can be seen as a solution for combating money laundering:

- Modeling Complex Relationships: Money laundering schemes often involve intricate networks of transactions and relationships between entities. GNNs excel at modeling and analyzing these complex relationships by treating them as graphs, where nodes represent entities (e.g., accounts, customers) and edges represent interactions (e.g., transactions, connections).

- Learning from Graph Structure: GNNs can learn from the structure of the financial network, capturing patterns and anomalies that may indicate suspicious activity. By considering the topology of the graph, GNNs can identify unusual transaction flows, hidden connections between seemingly unrelated entities, and other red flags indicative of money laundering.

- Incorporating Multiple Data Types: Financial data comes in various forms, including transaction records, customer profiles, and external data sources. GNNs are capable of integrating heterogeneous data types within a unified graph representation, enabling holistic analysis across multiple dimensions of information.

- Unsupervised Anomaly Detection: GNNs can perform unsupervised anomaly detection by learning the normal behavior of the financial network and identifying deviations from expected patterns. This approach is particularly useful for detecting previously unseen or evolving money laundering techniques that may not be captured by rule-based systems.

- Scalability and Efficiency: GNNs can scale to large and dynamic financial networks, making them suitable for real-time monitoring and analysis of transactions. Their ability to perform distributed computation allows for parallel processing of massive datasets, ensuring timely detection and response to suspicious activities.

- Adaptive Learning: GNNs can adapt and evolve over time by continuously learning from new data and adjusting their parameters accordingly. This adaptive learning capability enables GNNs to stay effective in detecting evolving money laundering tactics and adapting to changing regulatory requirements.

- Interpretability and Explainability: While GNNs are inherently complex models, efforts are being made to enhance their interpretability and explainability. By providing insights into the factors influencing their predictions, GNNs can help financial institutions and regulators understand why certain transactions or entities are flagged as suspicious.

Overall, GNN technology offers a promising approach for detecting money laundering by leveraging the inherent graph structure of financial networks and analyzing interconnected data sources. However, effective implementation requires collaboration between data scientists, domain experts, and regulatory authorities to ensure that GNNs are tailored to address the specific challenges of combating financial crimes while adhering to regulatory requirements and ethical considerations.

Building a Graph Neural Network (GNN) program to detect money laundering involves several steps, including data preprocessing, model architecture design, training, evaluation, and deployment. Here’s a high-level overview of how you could approach building such a program:

- Data Preprocessing:

- Gather financial transaction data from various sources, including transaction records, customer profiles, and external data sources (e.g., sanctions lists, watchlists).

- Represent the data as a graph, where nodes represent entities (e.g., accounts, customers) and edges represent interactions (e.g., transactions, connections).

- Encode node and edge features, such as transaction amounts, timestamps, and transaction types, into numerical vectors suitable for input into the GNN model.

- Split the data into training, validation, and test sets.

- Model Architecture Design:

- Choose a GNN architecture suitable for the task of money laundering detection. Common architectures include Graph Convolutional Networks (GCNs), Graph Attention Networks (GATs), and Graph Neural Networks (GNNs) with recurrent units.

- Define the layers and parameters of the GNN model, including the number of layers, hidden units, activation functions, and aggregation methods.

- Design auxiliary modules, such as attention mechanisms or recurrent layers, to capture complex patterns and relationships within the financial network.

- Training:

- Train the GNN model using the training data, optimizing a suitable loss function (e.g., binary cross-entropy) through backpropagation.

- Regularize the model to prevent overfitting by applying techniques such as dropout, L2 regularization, or early stopping.

- Monitor the model’s performance on the validation set and adjust hyperparameters as needed to improve generalization.

- Evaluation:

- Evaluate the trained model on the test set to assess its performance in detecting money laundering activities.

- Compute evaluation metrics such as precision, recall, F1-score, and ROC-AUC to measure the model’s effectiveness in identifying suspicious transactions.

- Conduct sensitivity analysis to understand the model’s robustness to different thresholds and parameter settings.

- Deployment:

- Integrate the trained GNN model into a production environment for real-time monitoring of financial transactions.

- Implement a user interface or API for interacting with the model, allowing users to input transaction data and receive predictions on the likelihood of money laundering.

- Develop alerting mechanisms to notify compliance officers or regulatory authorities of suspicious transactions flagged by the model.

- Iterative Improvement:

- Continuously monitor the performance of the deployed model and collect feedback from users to identify areas for improvement.

- Incorporate new data sources, features, or modeling techniques to enhance the model’s effectiveness in detecting evolving money laundering tactics.

- Regularly update the model’s parameters and retrain it on fresh data to ensure it remains accurate and up-to-date.

Throughout the development process, it’s essential to adhere to data privacy and regulatory compliance requirements, such as GDPR and AML regulations, and to involve domain experts and stakeholders to ensure the model’s relevance and effectiveness in real-world applications. Additionally, documenting the model’s decision-making process and maintaining transparency about its limitations and uncertainties is crucial for building trust and accountability.

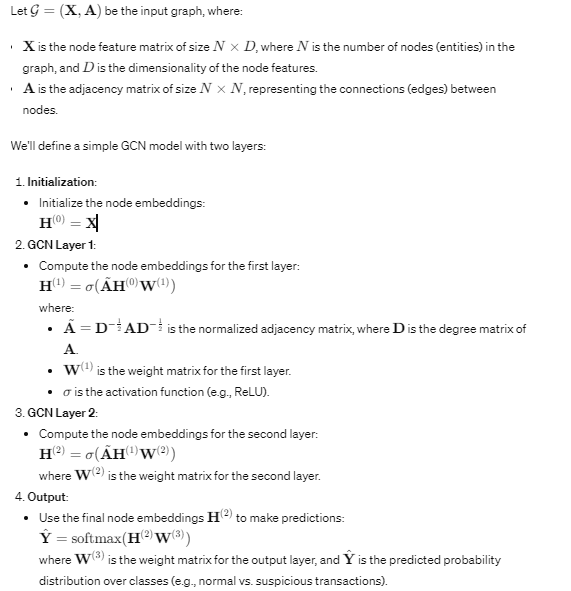

Now, Let’s outline a simplified mathematical model for a Graph Neural Network (GNN) to detect money laundering. We’ll focus on a basic Graph Convolutional Network (GCN) architecture, which is one of the common types of GNNs used for graph-based tasks like node classification.

5. Loss Function: Define a suitable loss function (e.g., cross-entropy loss) to measure the discrepancy between the predicted and true labels.

6.Training: Update the model parameters (weights) to minimize the loss using backpropagation and gradient descent or its variants (e.g., Adam).

This simplified model assumes a single graph with node features and binary classification (normal vs. suspicious transactions). In practice, you may need to adapt the model architecture and loss function to handle more complex scenarios, such as multi-class classification, heterogeneous graphs, and incorporating additional features or graph structures.

Additionally, it’s essential to preprocess the input data (e.g., normalize features, handle missing values) and perform hyperparameter tuning to optimize the model’s performance.

Now,

To model a money laundering detection system using a Graph Neural Network (GNN), we can represent the financial system as a graph where nodes represent entities such as customers, accounts, and watchlist risk indicators, and edges represent transactions between these entities. Here’s how we can structure the input data and model it using a GNN:

Input Data Representation:

- Node Features:

- Encode customer attributes (e.g., age, occupation), account characteristics (e.g., balance, transaction history), and watchlist risk indicators (e.g., flagged individuals or entities) into numerical vectors.

- Construct the initial node feature matrix �X containing the encoded features.

- Edge Features:

- Encode transaction features (e.g., amount, timestamp, type) into numerical vectors.

- Construct the adjacency matrix �A to represent the connections between nodes (entities) based on transactions.

- Graph Construction and Embeddings:

- Initialize node embeddings using the initial node features:

- Propagate information across the graph through multiple layers of graph convolution to refine node embeddings.

- Model Architecture:

- Design a GNN architecture with multiple layers of graph convolution to process the node features and edge connections.

- Each layer aggregates information from neighboring nodes and updates node embeddings based on the learned representation of the graph structure.

- Training Objective:

- Define the training objective, such as binary classification to detect suspicious transactions (e.g., money laundering) based on the learned node embeddings.

- Use labeled data to train the GNN model, adjusting the embeddings to minimize the loss function.

- Training Procedure:

- Train the GNN model using the labeled transaction data and optimize the model parameters to minimize the loss function.

- Update the node embeddings and model weights through backpropagation and gradient descent.

- Prediction:

- Once trained, apply the GNN model to predict the likelihood of suspicious activities for new transactions or entities.

- Use appropriate thresholding on the predicted probabilities to classify transactions as normal or suspicious.

- Evaluation:

- Assess the performance of the trained model using evaluation metrics such as accuracy, precision, recall, and F1-score on a validation or test dataset.

- Fine-tune the model and hyperparameters based on the evaluation results to enhance its ability to detect money laundering activities effectively.

By leveraging node embeddings in the GNN model, we can capture the complex relationships and interactions between entities in the financial system. The GNN learns to encode meaningful representations of the graph structure, enabling more accurate detection of suspicious activities indicative of money laundering.